An Extension of Time

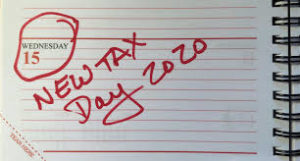

To say these last few months have been unprecedented would seemingly be an understatement. After months of business closures, disaster recovery, safer at home orders, and Coronavirus case tracking, nothing really feels quite normal these days. To help taxpayers, the Internal Revenue Service and Treasury Department announced in March that the federal income tax filing due date would be extended from April 15, 2020 to July 15, 2020 without penalty. If you haven’t already filed a federal tax return, the extension of time is almost over.

How Do I Apply for an Extension?

The extension of time applies to all individuals, corporations, and trusts, is automatic, has no additional penalties or interest, and no supplemental paperwork or forms to file in order to qualify. But with 20-25% of taxpayers waiting until the last minute to file their taxes, even with the extension, that leaves millions of Americans still needing to prepare and file a return. As the deadline gets closer, there are only two options: file your taxes posthaste or request an extension.

The extension of time applies to all individuals, corporations, and trusts, is automatic, has no additional penalties or interest, and no supplemental paperwork or forms to file in order to qualify. But with 20-25% of taxpayers waiting until the last minute to file their taxes, even with the extension, that leaves millions of Americans still needing to prepare and file a return. As the deadline gets closer, there are only two options: file your taxes posthaste or request an extension.

In order to meet the July 15th deadline and avoid unnecessary stress at the last minute, experts suggest a few universal tips that hopefully minimize costly mistakes, along with making the tax filing process easier. Getting organized is usually the best place to start. In preparation for filing your return, gathering all the necessary W-2, 1098, and 1099 forms, receipts, and social security numbers is the necessary step one. Every employer is required to file and give each employee a Form W-2 showing all wages paid and taxes taken for services performed by an employee. A Form 1098 is the mortgage statement showing mortgage interest paid on a loan for your home. A Form 1099 Miscellaneous Income is generally used for services rendered by someone who is not an employee, but was paid, or other income earnings.

How Should I File My Return?

After organizing the forms and paperwork, filing electronically is the fastest method for submitting individual and business tax returns. Whether you  plan to do your taxes yourself, or utilize a trusted bookkeeping expert, filing electronically is the safest and most reliable method available. Although the IRS does not endorse any particular software for IRS e-file, they are partnered with many companies to provide electronic filing to the public. Options include the IRS Free File for filers with adjusted gross income of $69,000 or under, commercial software, or authorized e-file providers via your tax professional. https://www.irs.gov/filing/e-file-options

plan to do your taxes yourself, or utilize a trusted bookkeeping expert, filing electronically is the safest and most reliable method available. Although the IRS does not endorse any particular software for IRS e-file, they are partnered with many companies to provide electronic filing to the public. Options include the IRS Free File for filers with adjusted gross income of $69,000 or under, commercial software, or authorized e-file providers via your tax professional. https://www.irs.gov/filing/e-file-options

Extending the extension until October 15, 2020 is an option for taxpayers who need more time beyond July 15th to file a return. To request an extension to file in October, individual filers need to submit Form 4868 to the IRS on or before July 15th. For businesses that need more time to file, Form 7004 needs to be submitted. The IRS reminds all taxpayers that both forms grant an automatic extension of time to submit income tax and other related information. Please note…an extension of time to file the return is not an extension of time to pay. Penalties and interest will begin to accrue on July 16, 2020 for any amount owed that is not submitted by the July 15th deadline.

A few key takeaways:

- The deadline to file and pay 2019 tax returns is extended to July 15, 2020

- The extension is automatic, there are no forms to file out, and penalties will not accrue between April 15th and July 15th.

- The IRS has all necessary tax forms on their website.

- E-filing is the most reliable method to file taxes

- If needed, filing an extension on or before July 15, 2020 will grant an automatic six-month extension of time to file tax returns, but not to pay taxes owed.

Serving customers and communities virtually is one of the hallmarks of Randolph Business Resources. We have always served our clients from the heart before COVID-19, and we will continue to do so after. We are here to help every step of the way.

Susan Amsler

June 15, 2020

Randolph Business Resources, LLC.

Our experienced staff are ready to lend a hand to you and your business.

Visit us @ www.randolphacctg.com

Call us at: (615)202-5829 if you need immediate assistance