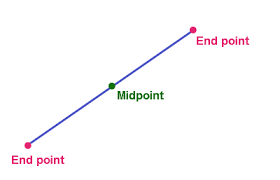

The Midpoint

In mathematical terms, the midpoint is the middle point of a line segment. It is an equal distance from both endpoints, and a point on the line segment that divides it into two equal parts. Only a line segment can have a midpoint, a line cannot since it goes on indefinitely. It is an exact halfway point and can be translated to a dataset as a median, the middle value of a series of values laid out in numerical order.

The median value lying at the midpoint indicates half of the values in your list will be less than the median, and half will be higher than the median. As of July 2, 2019, half of the year will be in the past, while the second half of the year is ahead and is commonly referred to as “mid-year.” The mid-year is when many people are enjoying summer with backyard bar-b-que’s, beach vacations, or weekend pool parties. The middle of the year is also a great time for a midpoint personal financial checkup. With six months until year end, now is great time to examine key aspects of your annual financial plan to see where things stand and plan accordingly for the rest of the year.

A great starting point is to adjust your tax withholding as needed. With numerous changes to deductions and credits via the Tax Cuts and Jobs Act of 2017, payroll withholding is a trending hot topic for many tax payers. Some filers were caught off guard by lower than expected refunds or higher tax bills at tax time. For others, there was no refund at all. In preparation for the upcoming tax seasons, considering an adjustment to W-2 withholding now may help avoid  unwelcomed surprises come tax time. Pay too little tax, risk penalty. Pay too much tax, you might be overpaying the government. The end-goal is to find that middle ground, or midpoint, for the number of claimed allowances and taxes withheld from each paycheck.

unwelcomed surprises come tax time. Pay too little tax, risk penalty. Pay too much tax, you might be overpaying the government. The end-goal is to find that middle ground, or midpoint, for the number of claimed allowances and taxes withheld from each paycheck.

Another pertinent midyear checkpoint is your annual budget. New Year’s resolutions made just six months ago always include saving money in the top five resolutions. Statistics show that over fifty percent of goal setters lose focus on their resolutions by January 31st, so the median point in a calendar year is a great time to revisit budget goals before the rest of the year comes and goes. Download bank and credit card statements for the last six months and review spending habits compared to your budget goals. Review at least one credit report to check for abnormalities and ensure credit balances are correct. Finally, if you don’t have a budget set for the year, now is a great time to make one. Actively budgeting is a sure-fire way to monitor spending habits, while potentially saving money for a sunny day at the beach!

By Susan Amsler

June 12th, 2019

Randolph Business Resources, LLC.

Our experienced staff are ready to lend a hand to you and your business.

Visit us @ www.randolphacctg.com

Call us at: (615)202-5829 if you need immediate assistance